What is Proposition 2½?

Proposition 2½ is a Massachusetts law passed by voters in 1980 that controls how much money towns can raise from property taxes (There is also an application for Automobile taxes, but we’ll ignore that for now). There are two main parts to the proposition:

- Levy ceiling: Towns can’t collect more than 2.5% of the total assessed value of all property.

Example: If all property in Hadley is worth $1 billion, the town can’t collect more than $25 million in property taxes. - Levy limit growth: Each year, the amount a town raises can only increase by 2.5% over the previous year, plus taxes from new growth (like new buildings or renovations).

Example: If Hadley collected $20 million last year, it can only go up to $20.5 million this year, unless voters approve more or unless it’s collecting new taxes on recent constructions.

What is an override?

An override is when residents vote to let the town raise taxes beyond the normal limit. It permanently increases the amount the town can collect. Towns use overrides when they need ongoing money for services like schools, fire, police, and public works.

Why is Hadley considering an override now?

Hadley’s fiscal year 2026 budget is $23.07 million, about 5% higher than last year. The regular 2.5% increase won’t cover that. Town officials say without an override, Hadley could face staff cuts, service reductions, or heavier reliance on reserves.

How big is the budget gap?

Hadley doesn’t have enough money to cover what departments asked for or even what the town’s financial team recommended.

- The budget is about $1.17 million short of what all departments requested.

- It’s about $952,000 short of the financial team’s trimmed-down plan.

- On top of that, the town needs to make up about $847,000 it used from “free cash” (savings) at Town Meeting in May just to balance this year’s budget.

Put simply: Hadley is running close to a $2 million hole if it doesn’t raise more money.

Has Hadley ever done this before?

No. This would be the first Proposition 2½ override in Hadley’s history.

How has the Town of Hadley shared information about this override vote?

The Town of Hadley has held several public forums about the override, and has shared information on its website, on social media and there have been a number of news reports about it. Hadley Media also streamed the forums, and they are available to view on YouTube.

How much money is being requested?

Officials are discussing $1.7 million to $2 million.

- A $1.7 million override would raise the tax rate to about $12.92 per $1,000 of property value.

- A $2 million override would raise the tax rate to about $13.15 per $1,000.

How would this affect my tax bill?

As broken down by The Daily Hampshire Gazette in July 2025,

For a home worth $450,000:

- $1.7 million override = about $580 more per year.

- $2 million override = about $684 more per year.

For a home worth $550,000:

- $1.7 million override = about $709 more per year.

- $2 million override = about $836 more per year.

Town leaders hope to keep the increase for the “average” Hadley home (about $453,000) under $700 per year.

When and where will Hadley voters decide on the Proposition 2½ override?

The Town of Hadley will hold a Special Town Meeting on Tuesday, September 9, 2025, 7:00–9:00 PM at Hopkins Academy to vote on a Proposition 2½ override.

What are the arguments for the override?

- Protect jobs: Up to a dozen town employees could lose their positions without the new revenue.

- Maintain services: Funding helps keep schools, fire, police, and other town departments running without cuts.

- Long-term stability: Override money becomes part of the annual budget, unlike one-time funds or reserves.

- Public choice: Residents, not officials, decide whether they want to raise revenue.

What are the arguments against the override?

- Higher property taxes: Some homeowners may struggle with the added cost.

- Reserve use: Even with the override, Hadley is drawing from its stabilization fund, raising questions about fiscal discipline.

- Trust and transparency: Some worry the town hasn’t explained clearly what cuts would happen if the override fails.

What happens if it fails?

Hadley would need to balance the budget by cutting services or staff. Officials warn that layoffs and reduced services are likely if the override doesn’t pass.

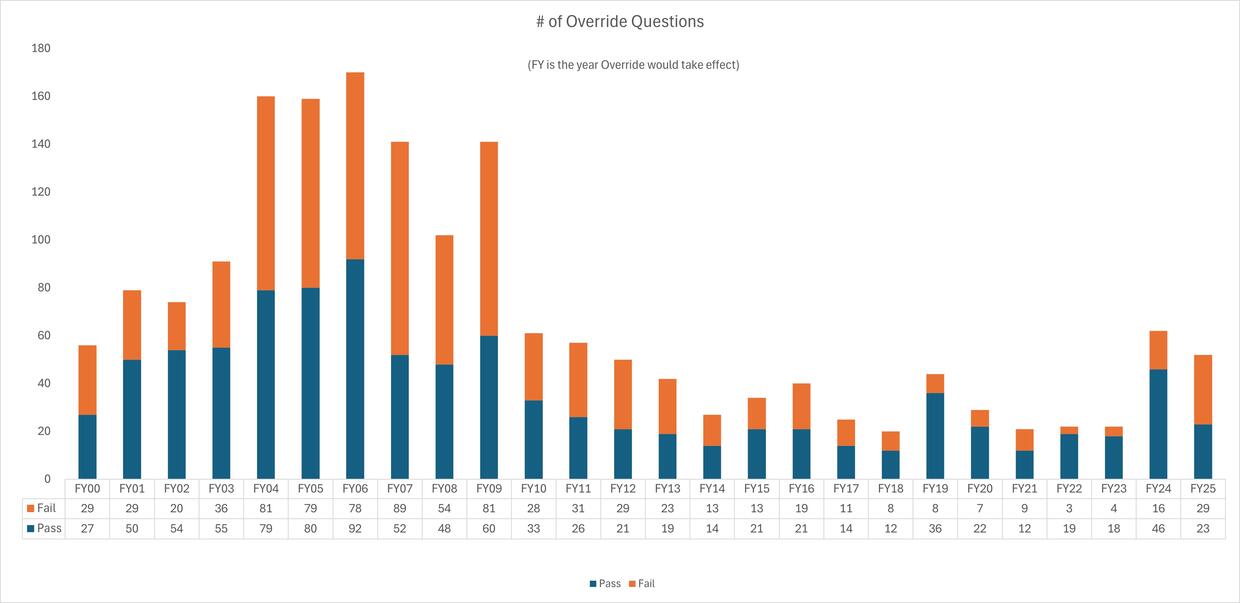

Has this happened in other Massachusetts towns?

Yes. Proposition 2½ overrides have been tried thousands of times since 1980. Historically, about 40% succeed. As of January 2009, municipalities had requested, via referendum, 4,449 overrides of Proposition 2½, of which 1,798 passed

- In FY 2025, 52 overrides went to the ballot in Massachusetts towns. 23 passed and 29 failed, raising a combined $48.2 million in new tax revenue where they succeeded.

- Towns that pass usually avoid cuts and stabilize services.

- Towns that fail often reduce staff, cut library hours, delay road work, or use reserves to plug gaps.

What happened in the early 1980s when Proposition 2½ first passed?

The first years after Proposition 2½ took effect saw steep reductions in local services statewide. Communities suddenly had to live under much tighter tax limits, and many hadn’t adjusted yet.

- Schools: Some districts laid off teachers, combined classes, or closed buildings.

- Libraries: Hours were cut back, and some branches shut down.

- Fire and police: Departments reduced staff or delayed equipment purchases.

- Public works: Road maintenance and infrastructure projects were postponed.

Those early years showed how quickly service levels could fall without extra revenue. Many communities eventually turned to overrides to restore funding.

Is there such a thing as an underride?

Yes. An underride is the opposite of an override. It’s when voters decide to lower the tax levy limit permanently.

Since 1980, there have been 24 underride votes statewide. 22 passed, cutting a total of about $11 million in allowable taxes. The most recent was in FY24 in Ware, where voters approved a $400,000 underride.

Where can I find more information about the override?

You can contact the Town of Hadley via phone at (413) 586-0221 or by email at info[at]hadleyma.gov. The Hadley town hall is located at 100 Middle Street, Hadley, MA 01035.

You will also find a lot of useful information in YouTube video below. It’s a recording of one of the forums held by the town to explain the override to residents. Forum date: August 7, 2025.

Please note that the opinions and information in this article are shared as a public service by Amherst Now and do not represent any official communication from the Town of Hadley. Make sure to check and verify any information before making your decision to vote yes or no.

PHOTOS: FungaiFoto.

GRAPHIC: Artist Dynamix for Amherst Now